Friend, it is time to rehash an old grudge I have against the 1% of the 1%. Our current tech moguls and the broligarchy they belong to (Trump’s new America), but this time my skin breaks out in a rash because the traditional Warren B-style wealth extraction has evolved into something even more shameless.

I have come to the conclusion that every economic crisis is rigged, and it forces the middle class to sell at bottom prices, so the ultra-rich can buy everything on discount and come out even richer.

And no, I’m not wearing a tin-foil hat today, and yes, I’ll explain it in the next section.

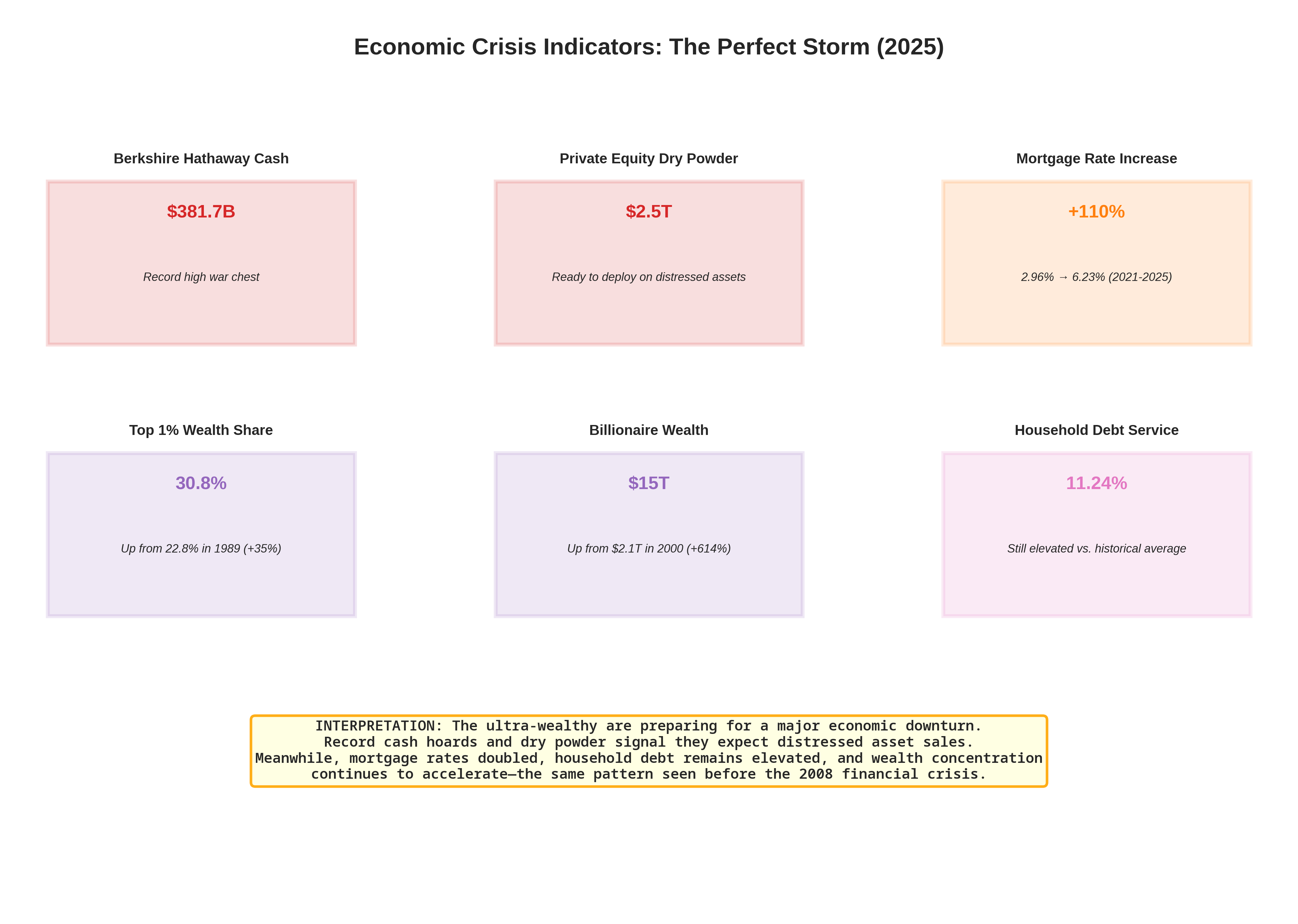

‡ Figure above: Six critical indicators that corroborate the claim that the ultra-wealthy are preparing for a major economic downturn while the middle class remains vulnerable.

More rants after the messages:

- Connect with me on Linkedin 🙏

- Subscribe to TechTonic Shifts to get your daily dose of tech 📰

- Please comment, like or clap the article. Whatever you fancy.

Subprime lending

If you pay attention, and study recent history of the human race a bit, you will start to see patterns. When I did my research for this article, I kept noticing the same economic pattern where the middle class pays the tab, the rich pocket the winnings, and their political buddies – whose campaigns and future jobs they bankroll – simply nod along like it’s all just the natural order.

I’m not blaming people for bad choices.

But I’m calling out a system that very stealthily lifts money upward whenever things fall apart, almost like it was built with a large suction tube pointed straight at your wallet. That pattern is visible in every major downturn, and I’m tired of pretending it’s random or driven by “market wisdom”, like goof ol’ Buffet is trying to make us believe.

And the thing is, we’re all chained to the system anyway, locked down by mortgages on houses we barely own, cars we’re still paying off, kids who need a “stable” upbringing plus a new Steam Deck, the joy of buying your way into healthcare if you’re in America, and, of course, that college debt that refuses to die even when you do.

To prove my point, let’s start with a “recent” event – recent if you’re my age, and likely yours too – the 2008 collapse…

The 2008 financial crisis showed how the machine really behaves. It was the year we all had to do a gracious swan-dive into a wood chipper because the financial elite decided that lending money to anyone with a pulse – or the suggestion of a pulse (that was enough) – was a great business model. The banks stuffed the world full of junk mortgages, gift-wrapped them, and put a “premium product” sticker on it, and sold that to everyone as if it was the second coming of investing.

This balloon popped when all those “totally fine, nothing to see here, carry on” loans revealed what they actually were . . . subprime mortgages.

A subprime mortgage is a polite industry term meaning we handed money to people we knew couldn’t pay it back, but the bonuses looked great so who cares.

These loans came with cute little teaser rates that later exploded into payments nobody could afford, and when they reset, defaults surged and then Wall Street woke up, and realized it had built an economic empire on borrowers who were below prime credit quality – sub prime – and the whole system imploded because everything underneath was stitched together out of bankers and investor’s greed, fantasies of personal grandeur, and mortgage applications written in blood.

The blood of the middle class.

Then those teaser rates expired, the payments tripled, but people defaulted . . . in droves, and the entire system collapsed like my folding garden chairs under my recently increased weight. And then, millions lost homes, their jobs, savings, hope, and probably their last bit of patience for capitalism’s they never had in the first place. And while we were coughing up blood just to pay the bills, the very banks that caused the explosion got bailed out by us taxpayers because their political buddies wanted to keep everything ‘stable’ (read: no revolution), and strangely enough, executives kept their bonuses, and us regular people were left staring at foreclosure papers while Wall Street toasted to ‘lessons learned’.

They learned nothing.

Middle-class households lost trillions through foreclosures, layoffs, and forced selling, and anyone holding actual cash treated the disaster like a clearance event.

Now, pay attention . . .

People sold their houses, and dumped stocks at the worst moment because they needed the money, not because they misread a candle chart. And wealthy buyers scooped up their houses and assets, locked them in, and watched the recovery do the rest.

Those economic ‘losses’ didn’t evaporate, because they just migrated to someone else’s balance sheet.

This is the point I’m trying to make.

Before every crash, big investors like Buffett (Berkshire Hathaway), Blackrock (the asset management death star), Vanguard, Blackstone, Apollo, SoftBank, . . . shall I go on? they quietly yank their stakes out of the very baskets they convinced everyone else to keep filling, while we are still nibbling on optimism.

Like, the current moment, but more about that later . . .

And when the shit finally hits the fan – probably the minute one of Nvidia’s GPU-addicted zombie borrowers keels over because they couldn’t refinance their debt and their backers suddenly realized profitability wasn’t arriving before 2030 – you’ll watch the economy swirl straight into the toilet again. Read Nvidia’s glorious, terrifying AI empire is being held together with debt and duct tape

People who bought homes at peak insanity prices (where I live the “average” house now costs half a million like that’s normal), will find out the hard way that gravity applies to real estate too, and the same institutions that inflated the bubble will be first in line to buy back their misery at a discount.

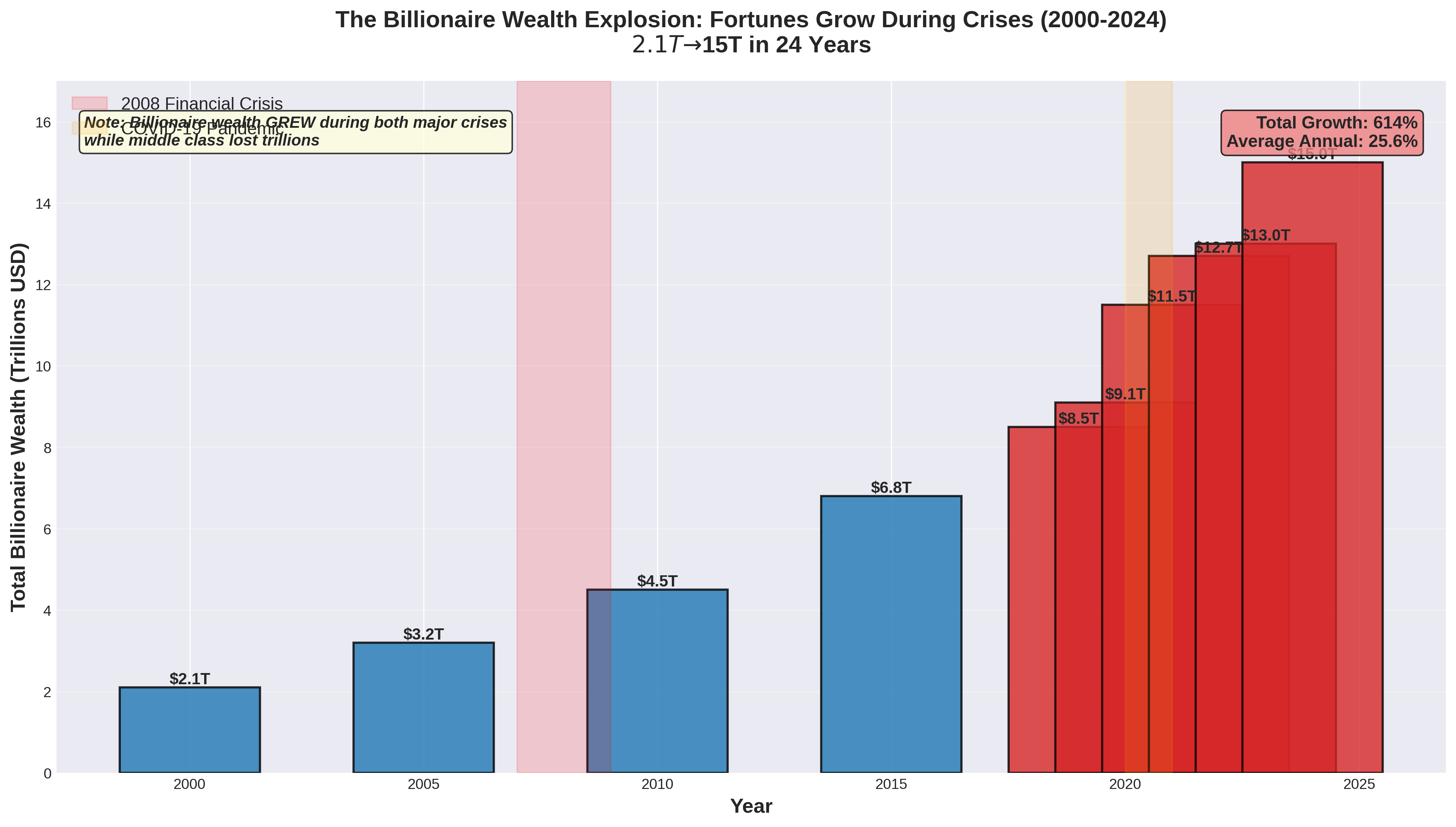

Jobs vanished overnight. Savings drained. Small businesses got erased. People sold investments to stay alive. And the billionaires boosted their net worth as if crises were loyalty programs. They didn’t innovate, nor did they reinvent something. They just stayed liquid while everyone else was forced to sell, and when the inevitable rebound arrived, the rewards flowed exactly where you’d expect.

Up.

That’s why the ultra-rich are now buying up infrastructure, land and housing.

Read We are in the midst of an incremental apocalypse and only the 1% are prepared – for background information, and data.

Follow the signs, people, and map it to history.

Cash hoarding for the war chest

Now we’re in 2025, and the setup looks suspiciously like the prelude to every other crisis.

Buffett is again squatting on hundreds of billions in cash. Private equity raised trillions like it’s prepping for a shopping trip during someone else’s emergency. Insiders have been unloading stock since 2023. The wealthy aren’t nervous if you were thinking that. They’re circling around the middle class – modern day slaves – like vultures, while we’re waiting for the good news that ain’t coming.

Notice the acceleration of their wealth (figure) during crisis periods (red and orange shading). The wealthy don’t lose during crashes. They gain.

Breaking the cycle down into phases helps expose what’s really happening. Cheap money inflates everything, the middle class buys in, and the wealthy quietly step out. Then rates rise, debt tightens, and cracks form and we keep believing it is temporary. Than the crash arrives, and forced liquidation starts. Of course, panic spreads, but the people who planned for it start buying. Eventually the government steps in, turns on the money hose, the surviving middle class lets out a shaky sigh of relief, and the rebound rewards whoever bought at the bottom.

History keeps handing out the same report card.

Every time the system snaps, the middle class absorbs the blow and big asset owners get rescued with policy tools and soothing language. Markets get priority, but households get sympathy, and a website to share their grief.

The rebound lifts their portfolios, but not your paycheck. The gap widens because the rules push in one direction.

The design of the system explains why this happens.

Take the Federal Reserve in the US. It was built by financial institutions and still behaves like their favorite support unit. Banks and investors get protected. Workers get condolences. Asset prices get life support. Incomes get “inspirational messaging” from politicians. The structure always favors capital holders in every crisis, and the outcomes show it.

Checking the indicators heading toward 2025 feels like I’m watching a slow-motion accident – on repeat.

The indicators are blinking red (but sure, let’s pretend it’s all just fine)

Because that is exactly what they want!

If you want to know whether a crisis is warming up, don’t bother with the motivational speeches from politicians or the “soft landing” bedtime stories from central banks. Just watch what the giants do with their money. Every indicator that matters is screaming, and the people with actual capital are acting like firefighters filling bathtubs full of cash before the inferno hits.

You start with looking at Buffett’s war chest instead.

Berkshire Hathaway is now sitting on more than $380 billion in cash and short-term treasuries that are piling up a liquidity fortress. This isn’t a rumor, by the way. It is all over the internet, and it’s officially filed and made public, and above all, it is boringly real. Just pick a source if you want to see if I’m hallucinating. CNBC has covered it, Yahoo Finance has covered it as well, and the SEC filings confirm it.

The thing is that you don’t hoard nearly half a trillion dollars unless you’re preparing for the mother of all market fire sales.

Then there’s private equity, which has collectively banked $2.5 trillion in “dry powder” (that’s the industry’s cute term for money waiting to pounce on distressed assets the moment everyday people panic and sell).

Remember that, people: DRY POWDER.

The estimates hover between $2.59 trillion and $2.62 trillion as of late 2024, depending on the firm who’s counting it. Firms like McKinsey and Preqin openly report it.

From the figure above it’s clear that billionaire wealth has grown 614% in 24 years, from 2.1$T to 15$T. Notice how wealth accelerates during crisis periods (red shading = 2008 financial crisis, orange = COVID-19). And during those crisis, families lost trillions, but billionaires got richer.

Now, take a look at housing.

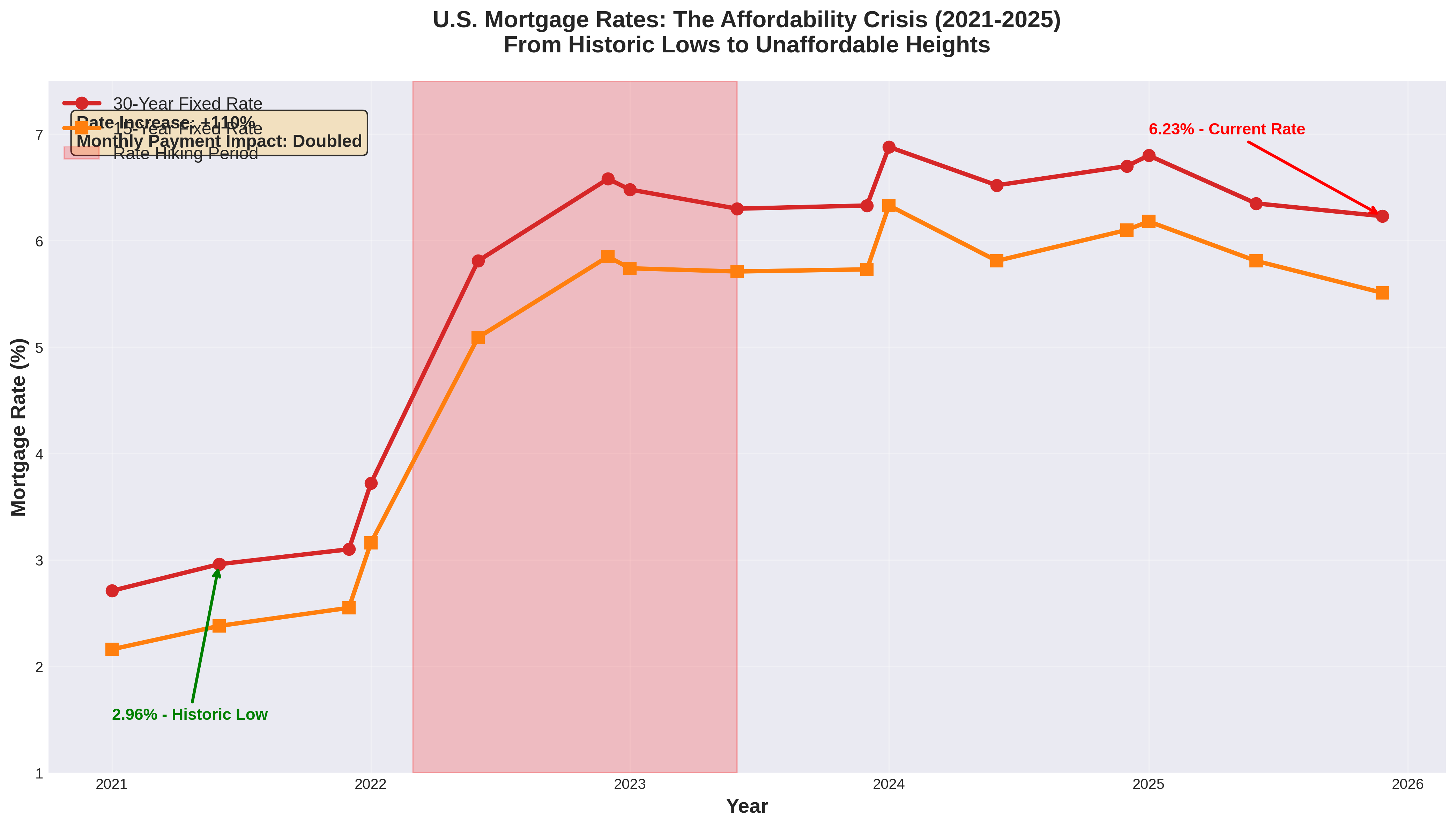

Mortgage rates that averaged 2.96% in 2021 are now slamming into the 6.2–6.3% range in 2025. The average family went from “maybe we can afford this” to “guess we’re gonna have to rent now”. Freddie Mac’s archive (just Google it), explains it with all the emotional warmth of a morgue report, that mortgage rates doubled, home affordability went down the pipe, and people are forced back into renting (maybe permanently).

The result is a housing market where normal people get locked out entirely, because doubling mortgage rates jacks monthly payments so high that only the already-wealthy or the already-funded can buy. Everyone else gets shoved back into renting, and must compete for the same overpriced boxes.

Take the Netherlands for instance

The situation in my country of birth (the Netherlands) is extra dire because they are sitting on a housing shortage of roughly 400,000 homes, on a population of 18 million, and those are only the official numbers. Then there are the students who have to live with their parents until they’re forty (the average age is now 32), so the actual number is more close to a million.

And that gap behaves like a pressure cooker with the lid welded shut. Demand keeps rising – new households, immigration, singles living with their parents – and supply crawl along at the pace of Dutch bureaucracy on a rainy Monday. Construction numbers keep dropping instead of rising because of conflicting laws (stupid Nitrogen EU mandate), so average housing prices are simply unaffordable, or can only be paid if both parents work full-time and outsource their kids to their grand parents. This leads to mortgage rates that doubled from the 2021 lows, and every new home is fought over like the last Playstation in a war zone.

With so few houses to go around, the entire market is now a bidding arena where the only people with a real chance are the wealthy, the cash-loaded, or the investors who collect properties like Pokémon. The middle class still gets to buy a house, but at phenomenally high prices. This shortage supercharges mortgage costs because high demand colliding with microscopic supply forces prices to explode upward.

When a mediocre “rijtjeshuis” – a copy-paste suburban row house that’s glued to ten identical neighbors – in Utrecht lists for three quarters of a million (sic), banks tighten rules, rates climb, monthly payments become absurd, and families get shoved back into renting for life (but rent is absurdly high as well). Inflation, regulatory delays, material shortages, and strict nitrogen rules choke new construction, pushing prices even higher.

The end result is a country where homeownership has morphed into a luxury product, the middle class gets priced out of its own neighborhoods, and anyone without a down payment the size of a Tesla deposit gets stuck watching investors hoover up the last remaining houses at inflated prices, so they can sell it at triple rent. It’s not that the market is broken, it’s functioning exactly as a scarcity machine is designed to function – squeezing everyone at the bottom and rewarding anyone holding cash at the top.

The commercial real estate indicator

Then there’s the commercial property wall of doom, where somewhere between $1.5 trillion and $2 trillion in loans must be refinanced by 2026. (sic). Most of those loans were priced for a zero-percent world that vanished the moment Jerome Powell discovered his inner Volcker**‡.** Analysts at MSCI and Moody’s keep warning that the math simply doesn’t work. You don’t refinance 3% loans at 8% without something or someone snapping.

Speaking of snapping, the regional banks already broke once.

First it was Silicon Valley Bank, then Signature, then First Republic – all in 2023. In 2024, Republic First Bancorp got seized and folded into Fulton Bank. Regulators patched the leaks with duct tape and confidence theater, though nothing about the underlying risk changed.

And that’s the canary in the coal mine. If the commercial property wall collapses under those impossible refinancing costs, the same banks that already buckled once will be the first to get flattened again, because they’re stuffed with the very loans that can’t roll over. When that happens, no amount of duct tape, soothing press conferences, or emergency weekend mergers will hide the fact that the structure is rotten.

Then there’s insider behavior

Also flashing red. Executives have been unloading shares throughout 2023 and 2024 like their paychecks depend on not being the last ones holding the bag. The execs are the people who are running top companies, and they see the real numbers – the ones not meant for public consumption.

The proof of this is in plain sight. EC Form 4 filings, the legally-required disclosures where insiders must report every stock sale. Anyone can look them up on https://www.sec.gov/edgar – which is why the claim isn’t speculation but a smoking gun. Insider-tracking platforms like MarketBeat, GuruFocus, OpenInsider, and VerityData pulled the aggregated numbers for 2023 and 2024, and yes, insider selling hit some of the highest levels since 2007, right before the last big one blew up.

VerityData even flagged record tech-sector insider selling in 2023 – Meta, Amazon, Google, Tesla, Salesforce, Nvidia, all with execs unloading stock in patterns you only see when the people with backstage passes don’t like the script.

OpenInsider’s data feed shows CEOs, CFOs, and board members selling far more than buying across the S&P 500 during the entire AI-mania run. And these aren’t day-traders or hype-chasers. They’re the people who see the real revenue numbers, the burn rates, the refinancing deadlines, the losses buried under “adjusted metrics”, and the debt maturities that the public won’t learn about until the earnings call “surprises” them.

‡ Jerome Powell is today’s Fed chair, Paul Volcker was the 1980s Fed chair who killed inflation with brutal rate hikes, triggering a recession.

And as always we are fully exposed

The middle class is standing out in the open again, bare to the storm as usual.

Household debt is at historic highs. Wages haven’t kept up. Companies are at record high profits, yet aren’t investing in humans anymore, they’re even letting thousands of people go. Interest payments chew through every paycheck. Credit card APRs hit rates (in the US) that should legally count as daylight robbery.

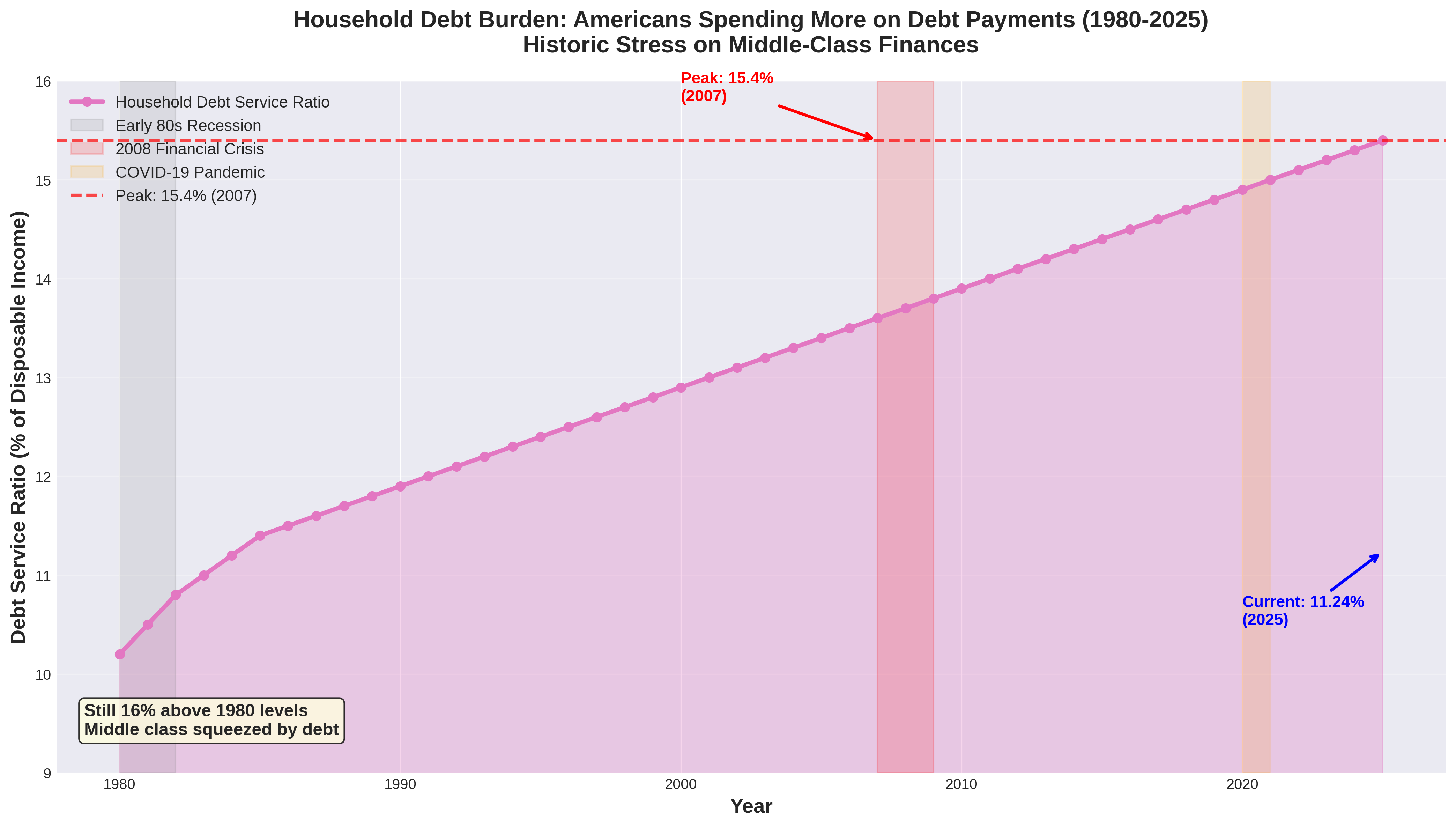

Households are spending 11.24% of their disposable income on debt. 16% above the 1980 levels! The peak of 15.4% during the 2008 crisis just shows how vulnerable families become during downturn.

And all of that happens while the richest people on the planet sit in cash, silent, watchful, and disturbingly comfortable.

Everything in the data points one way. Cash is piling up at the top. Debt is stacking up at the bottom. Stress fractures are running through the system. And the people with the insider dashboards – the ones who know the real numbers and carry the most to lose – are moving as if the crash is already underway.

While the top 1% wealth share climbed from 22.8% to 20.8%, household debt service rose from 10.2% to 11.24% of disposable income. This inverse relationship is not coincidental. IT IS SYSTEMATIC.

I am bringing you the unpolished reality buried in SEC filings, rate charts, refinancing calendars, delinquency curves, insider sales, liquidity hoards, and balance sheets that only behave like this when something large, hostile, and profitable-for-some is approaching. The signals are staring us in the face.

If the economy had a control panel, every LED would be blinking red and the alarm would be locked in maximum volume doing it’s slow woop. And the only people preparing for impact are the same ones who always glide away untouched, leaving everyone else to sweep up the wreckage.

Signing off,

Marco

I build AI by day and warn about it by night. I call it job security. Big Tech keeps inflating its promises, and I just bring the pins and clean up the mess.

👉 Think a friend would enjoy this too? Share the newsletter and let them join the conversation. LinkedIn, Google and the AI engines appreciates your likes by making my articles available to more readers.

To keep you doomscrolling 👇

I may have found a solution to Vibe Coding’s technical debt problem | LinkedIn

- Shadow AI isn’t rebellion it’s office survival | LinkedIn

- Macrohard is Musk’s middle finger to Microsoft | LinkedIn

- We are in the midst of an incremental apocalypse and only the 1% are prepared | LinkedIn

- Did ChatGPT actually steal your job? (Including job risk-assessment tool) | LinkedIn

- Living in the post-human economy | LinkedIn

- Vibe Coding is gonna spawn the most braindead software generation ever | LinkedIn

- Workslop is the new office plague | LinkedIn

- The funniest comments ever left in source code | LinkedIn

- The Sloppiverse is here, and what are the consequences for writing and speaking? | LinkedIn

- OpenAI finally confesses their bots are chronic liars | LinkedIn

- Money, the final frontier. . . | LinkedIn

- Kickstarter exposed. The ultimate honeytrap for investors | LinkedIn

- China’s AI+ plan and the Manus middle finger | LinkedIn

- Autopsy of an algorithm – Is building an audience still worth it these days? | LinkedIn

- AI is screwing with your résumé and you’re letting it happen | LinkedIn

- Oops! I did it again. . . | LinkedIn

- Palantir turns your life into a spreadsheet | LinkedIn

- Another nail in the coffin – AI’s not ‘reasoning’ at all | LinkedIn

- How AI went from miracle to bubble. An interactive timeline | LinkedIn

- The day vibe coding jobs got real and half the dev world cried into their keyboards | LinkedIn

- The Buy Now – Cry Later company learns about karma | LinkedIn

Leave a comment