Nvidia just turned in another record-shattering quarter. 57 billion dollars in revenue. It’s up 62% from last year, and investors initially lost their collective minds in joy before remembering to panic again five minutes later.

Heeeey! Ay-ay-aaaayyy.. Shares jumped 2.85% at close, spiked another 5.08% after-hours, and then promptly fell on it’s ass because Nvidia is now in a “no-win situation”, according to leather Jensen himself.

This was Q3 2025 people, the quarter where Nvidia became the world’s most valuable company and also one unexpected sneeze away from the entire planet clutching their pearls and texting “AI BUBBLE!” to one another, while sprinting in circles like coked-up lab rats.

Under all the fireworks and the leather-jacket swagger sits a single, awkward truth, that Nvidia ain’t selling GPUs no more.

Nah, just kidding.

But selling would mean a cash-flow towards them, ama right? Wrong. Because Nvidia is financing their customers. Nvidia has become a bank.

And not even a glamorous bank for that matter, but the kind that lends money to friends who swear they’ll pay you back after “the next funding round”.

The man must have a lot of faith in his pals.

Its biggest AI customers, CoreWeave, OpenAI and xAI, are all drowning in debt, and they’re burning cash at spiritually concerning speeds, and all are leaning on Nvidia like teenagers leaning on their parents’ credit card to buy Supreme hoodies.

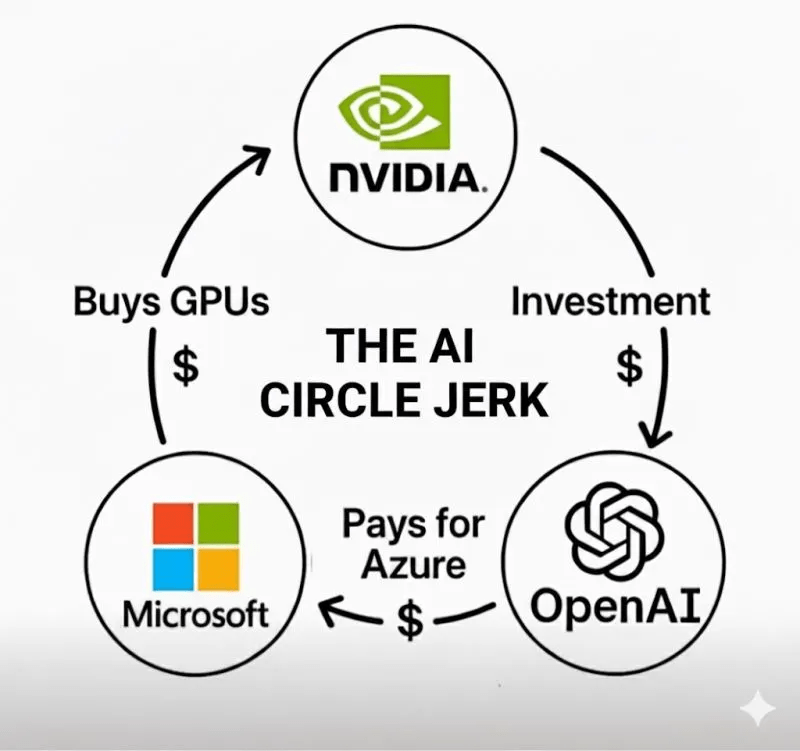

Remember this image I made some time ago?

The numbers look heroic, 57 billion – a – quarter, but then you realize that the entire tower is sitting on customers who cannot afford the hardware they’re ordering.

Not in cash that is. Heck, not even remotely!

This is not a world of financing a 60,000 dollar car. Nvidia is in a world where they’re financing twelve billion dollars worth of industrial-grade computer systems because someone thought “training the next model” would magically generate revenue sometime later.

Nvidia has shoved over 110 billion dollars into direct investments plus roughly 15 billion more into GPU-backed SPV debt. That is 67 percent of its annual revenue. Lucent melted down with twenty-four percent. Nvidia is sitting at nearly three times that risk and smiling like everything is fine.

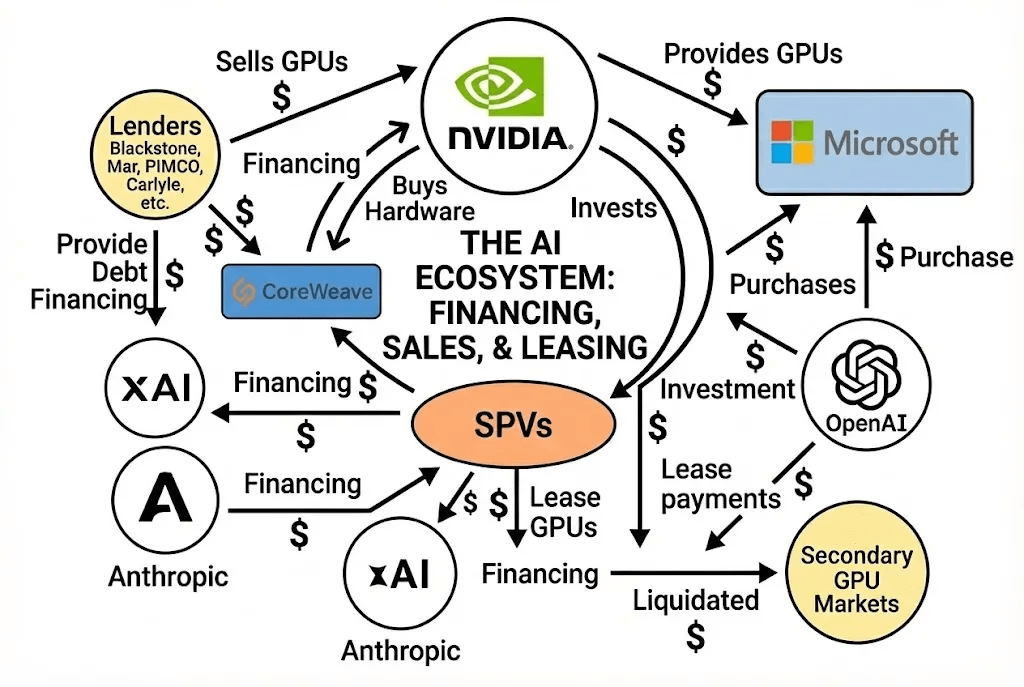

The image is now more like this one:

Yeah, that’s kinda unclear to me as well.

Allow me to explain.

More rants after the messages:

- Connect with me on Linkedin 🙏

- Subscribe to TechTonic Shifts to get your daily dose of tech 📰

- Please comment, like or clap the article. Whatever you fancy.

The Special Purpose Vehicle

At the center of this whole freak show is something called an SPV. That’s short for Special Purpose Vehicle, and that is financese for “A legally separate company created for one very specific financial stunt, so the real company doesn’t get its hands dirty if things go sideways”. It’s a financial sock puppet that they created to hold debt, borrow money, buy expensive things, take risks and fail quietly if needed. . . without dragging the parent company down with it when this happens.

You can compare the SPV structure powering this whole monster to a GPU laundromat. Of course, Nvidia does not lend directly – heaven forbid – it would look too obvious that they’re financing their own record breaking revenue, so instead they spin up the SPV that raises equity and creates a colossal debt, then it buys billions of Nvidia GPUs, and leases them back to the AI startup.

Doesn’t that sound kinda phishy to you as well? Yeah, thought so.

Nvidia books the entire lease value as revenue upfront.

Uh-huh. Even though the cash arrives over five years like a late postal delivery.

The AI startup gets clean books this way, and Nvidia gets shiny revenue numbers, and the actual credit risk gets stuffed into these vehicles like old tax receipts under my bed. And beneath that is the spread between Nvidia’s own cost of capital and what it charges customers, and that is eating billions annually.

Allow me to explain this to the simpletons among us (not you).

Nvidia is borrowing money at high interest…

and then turning around and lending that money to AI companies at almost no interest.

So Nvidia pays a lot.

Their customers pay almost nothing.

And Nvidia loses the difference.

That difference is called the spread, and it’s burning billions of dollars every year like they’re trying to build a GPU-powered bonfire.

Yeah, Nvidia takes expensive loans and gives out cheap loans, and the gap makes money disappear. That’s it. That’s the whole scandal.

And what a scandal it is.

Nvidia’s capital costs hover somewhere between nine and eighteen percent. Customers often pay zero to two percent. On a financing book of 110 billion, that is up to seventeen billion dollars in annual margin bleed. It does not show up cleanly in gross margin, but it sure shows up in reality.

This all becomes funnier or more horrifying depending on your investment tolerance because a massive maturity wall is coming fast.

CoreWeave alone faces over one and a half billion dollars in debt payments by October 2025.

Its interest expense has tripled year-over-year, and its covenants† require future revenue to cover repayments, which is all fine ‘n dandy until their customers start delaying deployments or cancel projects. And if they cannot refinance by early 2026, CoreWeave gets shoved into restructuring and Nvidia’s seven percent equity stake gets wiped like chalk on a rainy sidewalk.

Yup. It’s that nasty.

And Nvidia may then be forced to prop up GPU collateral across related SPVs, possibly by buying back hardware at deeply discounted prices.

OpenAI isn’t helping matters either because they are burning cash at fifty-seven percent of revenue, and that is setting money on fire and then complaining about the heat. They’re spending around 1.57 dollars per dollar earned (sic), and they expect losses of eight to nine billion in 2025 on about thirteen billion in revenue.

The company predicts to become cash-flow positive somewhere around 2029 or 2030, which is the same optimism Sam “the Scam” Altman had when predicting AGI → 2025, oh no, sorry → 2028, uh, um → 2030.

That’s the same as planning your retirement around lottery winnings is optimistic. Nvidia committed up to one hundred billion dollars to OpenAI. If the next funding round is flat or down, Nvidia’s later tranches become worth less, and write-downs begin knocking at the door like a Jehovah’s Witness.

And then there’s xAI who is raising about fifteen billion at a valuation of near two hundred and thirty billion. And Noel Skum is doubling it from earlier in 2025 without even a matching step-up in revenue, all based on the oak-leaves he got from setting up Tesla. He is spending heavily on his “Project Colossus” data center, and he’s burning investor optimism like incense in a temple of doom. And if valuations are reset by even thirty percent, Nvidia’s commitments shrink in value instantly, than all of a sudden, the multi-billion-dollar bets become very visible on the balance sheet.

The day the GPUs died. . .

…and we were singing “bye-bye, missy silicon pie”, …drove my SPV to the levy but the levy was dry …and all the AI boys were drinking whiskey ‘n rye …singing bye-bye to that $5 trillion high …and Jensen cried into his american pi(e).

Some’n like that.

It always starts quietly.

One customer – one of Nvidia’s debt-inflated, SPV-cushioned GPU-addicts – misses a refinancing deadline. It’s just a wobble, nothing more. Then the entire structure shivers, because in Nvidia’s world, a single failure is someone shoving a refrigerator into a kiddie pool, and the shockwave that follows hits everything.

If CoreWeave can’t refinance its $1.5 billion wall, the covenants snap, lenders seize hundreds of thousands of GPUs, and those GPUs get dumped into secondary markets at 30–50% discounts. And then, every SPV that is tied to Nvidia’s vendor financing loses half its collateral value over night.

It’s Lucent all over again. You know Lucent? Maybe if you dig deep in your memory and go back to the 90’s you will. Lucent was a giant telecom company that blew itself up by doing exactly what Nvidia is doing now, financing its own customers so they could afford its expensive hardware. And when those customers couldn’t pay, Lucent’s “revenue” evaporated, collateral collapsed, and the stock fell from $80 to $2 in under eighteen months. It is now the textbook case of how vendor financing turns bad if you do it at such a large scale as Lucent. That’s why everyone brings up Lucent, it’s the ghost hovering over Nvidia’s balance sheet – except Nvidia’s exposure is seven times larger. And simple math does not tell jokes.

The SPVs collapse one by one. Loan-to-value ratios implode, covenants detonate, lenders call in debt early, and Nvidia is forced to reverse revenue it already booked – revenue that never existed as cash in the first place. So as a result, billions evaporate in hours, and the record quarters get rewritten as accounting hallucinations. Nvidia is suddenly clawing back income, marking down stakes in OpenAI, CoreWeave and xAI, repurchasing GPUs at basement prices, and explaining to Wall Street why half its empire was built on IOUs.

Wall Street panics instantly. Of course they do.

Nvidia’s price / earnings ratio compresses and analysts will be crying “AI BUBBLE” to the press, and traders start dumping anything that smells like compute. So, in this scenario, a 25–35% drop in a week becomes completely plausible – historically normal, even – as investors sprint away from any company entangled in Nvidia’s credit spiderweb.

Secondary GPU markets crater, and used GPU sellers become prophets of economic doom.

Next, we’ll see AI startups implode as if they’re made of wet cardboard. CoreWeave, of course, collapses first. Then, OpenAI’s “$1.57 spent for each $1 earned” burn profile becomes fatal. xAI’s $230B fantasy valuation evaporates the moment collateral melts, and Anthropic stands there, as always, like a douche holding a sparkler over a gasoline puddle.

And then . . .

💥

The entire AI engine sputters. Training freezes. Inference prices spike. Cloud providers ration compute like electricity is now on food stamps. Then governments panic, who had decided to stick their heads in the sand and not plan for the inevitable, and of course, economists pretend they predicted it all along.

And then you’ll see the public perception flip just as violently.

AI is not a thing of “the future” anymore, and becomes “the thing that blew up the stock market”.

As usual, dumb politicians blame tech greed, and tech blames rates, and rates blame Jerome Powell’s receding hairline‡, and “GPU” becomes a curse word, a new “subprime loan”

Nvidia will not die, but its myth does.

The stock craters, our collective morale caves, and analysts downgrade until there’s nowhere lower to go. Jensen’s leather jacket, once iconic, becomes a thing you can buy on eBay, as a tragic relic of better days.

And the irony is that the demand didn’t go away. The demand for GPU is real, it’s massive, ravenous even.

But what undermined Nvidia wasn’t a lack of demand, it was the fragile, debt-laden financing machinery they built to keep that demand flowing. And this structure helped inflate the company to the top of the valuation rankings long before the underlying cash actually arrived. And since Huang gets equity grants, his wealth is absolutely tied to Nvidia’s situation.

It’s a very fragile construction, and it makes my kid’s Jenga tower look structural-engineered.

Lucent is the ghost. Nvidia is the mirror. And the numbers this time are bigger.

Much, much bigger.

Signing off,

Marco

† No, not the Covenant from Halo, but with a lower cap c. It’s a rule in a loan agreement that makes you must keep your finances healthy in specific ways. It’s basically a list of conditions you must follow so the lender doesn’t panic.

‡ US Federal Reserve dude.

I build AI by day and warn about it by night. I call it job security. Big Tech keeps inflating its promises, and I just bring the pins and clean up the mess.

👉 Think a friend would enjoy this too? Share the newsletter and let them join the conversation. LinkedIn, Google and the AI engines appreciates your likes by making my articles available to more readers.

To keep you doomscrolling 👇

- I may have found a solution to Vibe Coding’s technical debt problem | LinkedIn

- Shadow AI isn’t rebellion it’s office survival | LinkedIn

- Macrohard is Musk’s middle finger to Microsoft | LinkedIn

- We are in the midst of an incremental apocalypse and only the 1% are prepared | LinkedIn

- Did ChatGPT actually steal your job? (Including job risk-assessment tool) | LinkedIn

- Living in the post-human economy | LinkedIn

- Vibe Coding is gonna spawn the most braindead software generation ever | LinkedIn

- Workslop is the new office plague | LinkedIn

- The funniest comments ever left in source code | LinkedIn

- The Sloppiverse is here, and what are the consequences for writing and speaking? | LinkedIn

- OpenAI finally confesses their bots are chronic liars | LinkedIn

- Money, the final frontier. . . | LinkedIn

- Kickstarter exposed. The ultimate honeytrap for investors | LinkedIn

- China’s AI+ plan and the Manus middle finger | LinkedIn

- Autopsy of an algorithm – Is building an audience still worth it these days? | LinkedIn

- AI is screwing with your résumé and you’re letting it happen | LinkedIn

- Oops! I did it again. . . | LinkedIn

- Palantir turns your life into a spreadsheet | LinkedIn

- Another nail in the coffin – AI’s not ‘reasoning’ at all | LinkedIn

- How AI went from miracle to bubble. An interactive timeline | LinkedIn

- The day vibe coding jobs got real and half the dev world cried into their keyboards | LinkedIn

- The Buy Now – Cry Later company learns about karma | LinkedIn

Leave a comment